The true SaaS

trade finance platform

You are a financial service provider and want to leverage the possibilities of latest technologies to automate your complete trade finance processes?

LiquidityHub, the most innovative platform in the trade finance industry, delivers fully integrated services for trade finance products – always customized to your needs, completely on cloud and yet 100% compliant. We connect all actors of trade finance processes: investors, financial service providers and customers. You decide how your product should look like – we deliver the technology to make it possible. Let us give you more insights.

LiquidityHub – best in class service

Co-Innovated with SAP in 2021, the world’s market leader for business software.

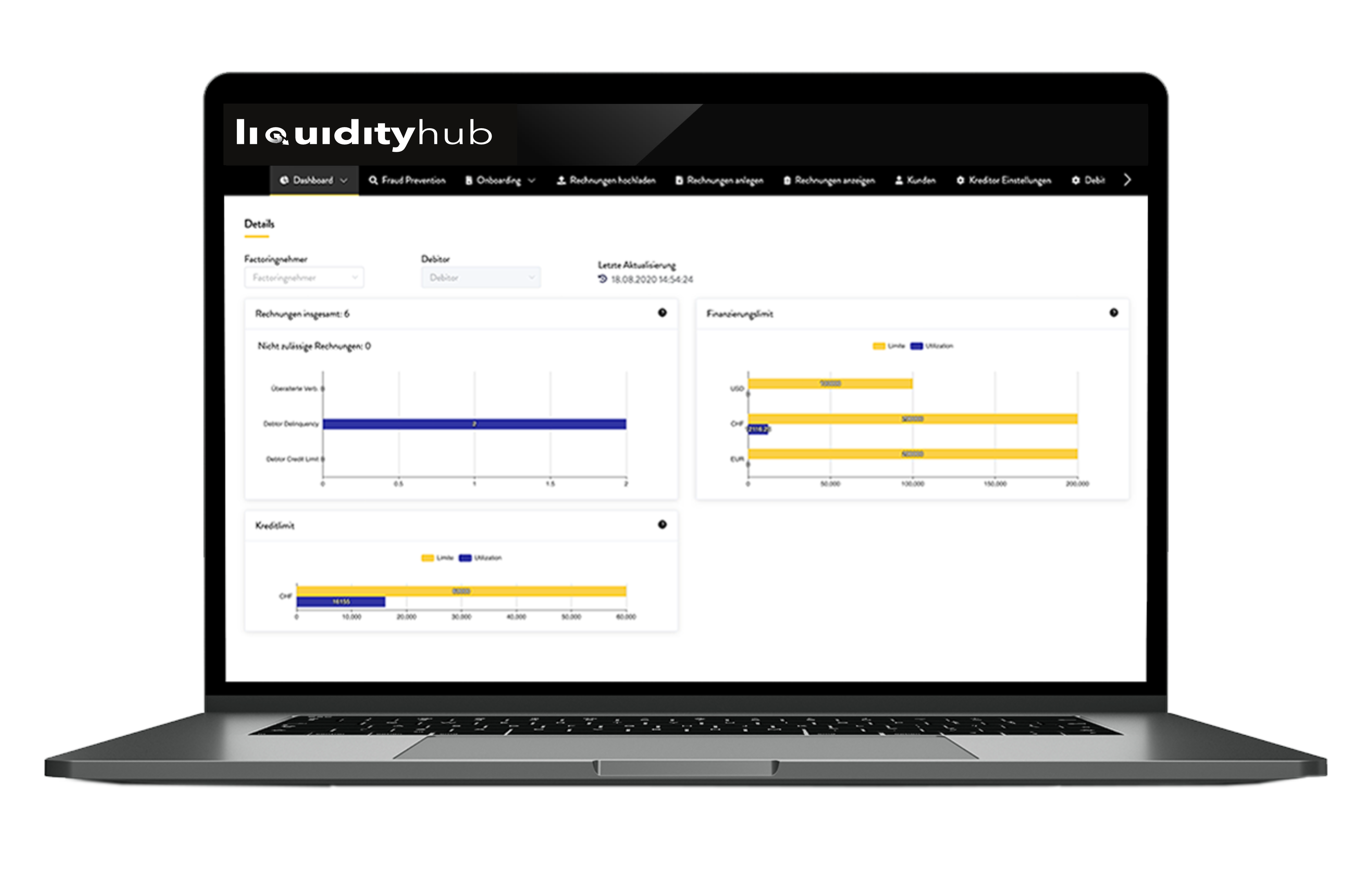

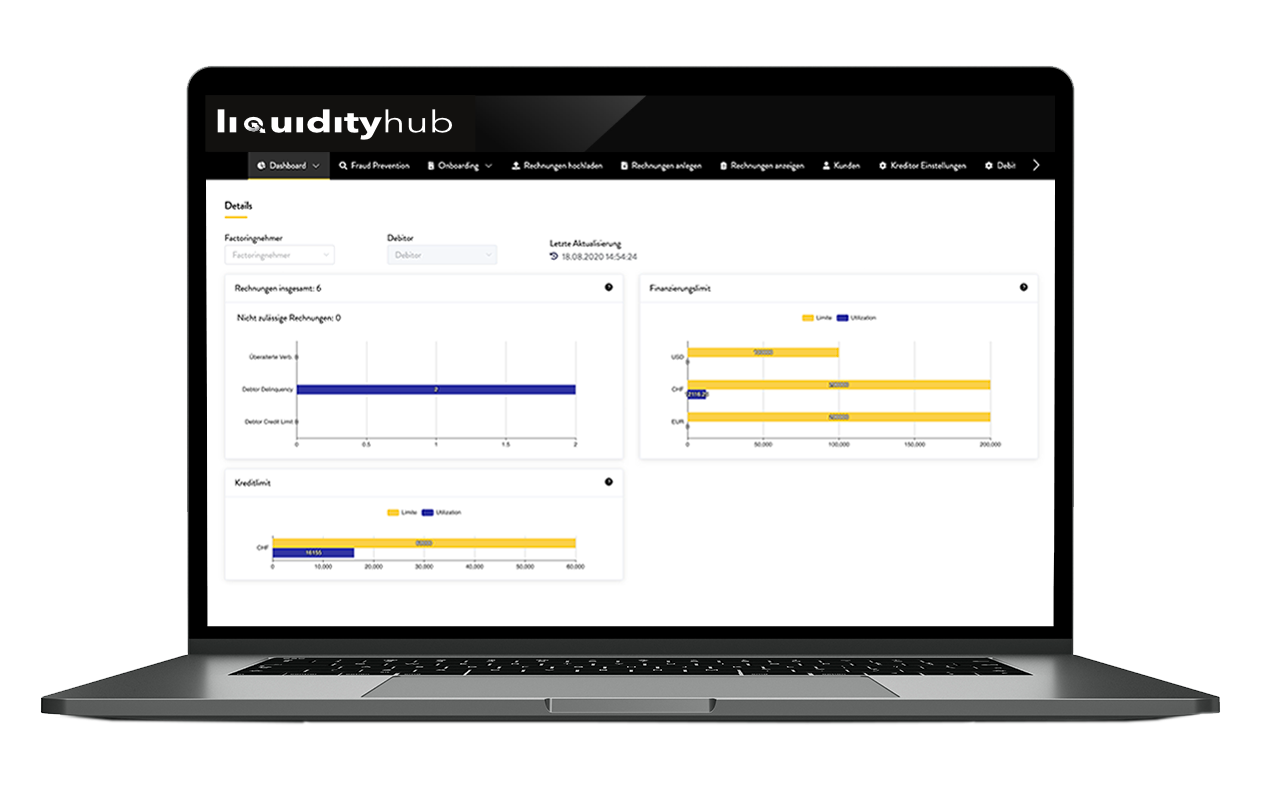

Meet LiquidityHub, the innovative cloud platform

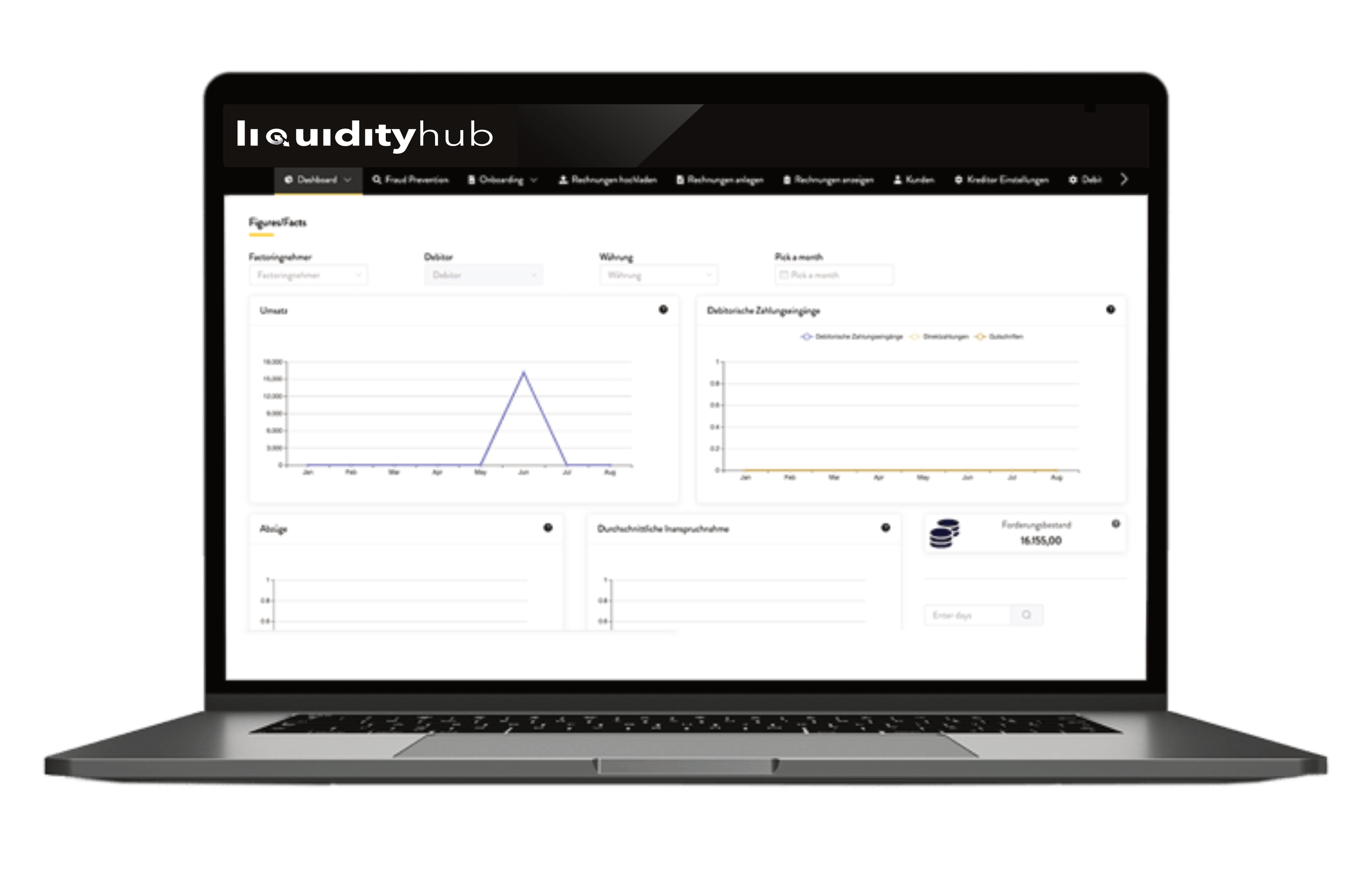

We have combined over 20 years of experience in the financial industry with the best technology from SAP to create a global, agile and future-ready platform. With the advantages of the best in class SAP® solutions like SAP® Cloud Platform, SAP® Analytics Cloud and SAP S/4HANA® we assure fully automated, always compliant, highly secure and fully transparent processes for trade finance products. All on cloud, without any local IT. No development needed, only configuration.

Different trade finance products in one platform

Full Service Factoring, Inhouse Factoring (disclosed and non-disclosed) and Reverse Factoring are just a few of the products that co-exist fully-integrated in the LiquidityHub platform. Thanks to great flexibility, you can design your trade finance product completely based on your needs.

Doing business internationally and in different currencies has never been easier

With LiquidityHub it doesn’t matter in which country or in which currency you operate. We cover most of them thanks to the great coverage of compliant issues and accounting standards by the best SAP® technology, which builds the backbone of our platform.

Integrate and exchange data with your partners in real-time

LiquidityHub can work with different ERP systems. It also provides full integration to your preferred banks, KYC data providers and credit insurers. The perfectly developed APIs can significantly speed up your processes even when multiple providers are involved.

Fully automated end-to-end processes

LiquidityHub contributes significantly to increasing the efficiency of your processes by reducing manual tasks by 90%. Due to a very high automation degree, the probability for human errors and possibilities for fraud are massively reduced. Manual intervention is needed only for exception handling.